The FEIE Standard Deduction: Why it matters for digital nomads

Wiki Article

Checking Out the Foreign Earned Earnings Exemption and How It Connects to Your Standard Reduction

The Foreign Earned Revenue Exemption (FEIE) presents a significant chance for migrants to reduce their U.S. tax responsibility. Comprehending the qualification requirements and determining international made earnings is important. This exemption makes complex the option in between taking full advantage of and asserting the conventional deduction tax benefits. Navigating with these complex guidelines can cause considerable economic effects. What approaches can individuals use to optimize their tax scenario while continuing to be compliant with internal revenue service laws?Recognizing the Foreign Earned Revenue Exclusion (FEIE)

Although many U.S. residents working abroad may face complex tax obligation responsibilities, the Foreign Earned Revenue Exclusion (FEIE) provides considerable relief by allowing qualified people to omit a portion of their foreign earnings from united state taxes. This provision is designed to relieve the monetary problem of dual taxation on revenue gained in international countries. By using the FEIE, certified taxpayers can omit up to a defined limit of foreign gained revenue, which is readjusted yearly for rising cost of living. The exclusion uses just to income originated from employment or self-employment in an international nation and does not cover other sorts of income, such as financial investment revenue. To take advantage of the FEIE, people must submit the ideal tax return with the IRS and ensure compliance with particular needs. Eventually, the FEIE functions as a crucial tool for united state citizens steering the intricacies of worldwide tax while living and working abroad.Qualification Needs for the FEIE

To qualify for the Foreign Earned Revenue Exemption (FEIE), individuals have to satisfy details requirements developed by the IRS. First, they should have foreign earned income, which describes incomes, wages, or professional costs gotten for solutions done in an international country. In addition, the taxpayer needs to either be an authentic homeowner of a foreign country or meet the physical existence test, which needs investing at least 330 complete days in an international country throughout a 12-month period.Additionally, the taxpayer must file Form 2555 or Kind 2555-EZ to claim the exclusion. It is likewise crucial to note that the FEIE uses only to earnings earned while living outside the United States; consequently, any type of earnings from united state sources or for services carried out in the united state does not qualify. Comprehending these qualification demands is necessary for individuals looking for to take advantage of the FEIE.

Computing Your Foreign Earned Income

Determining foreign made revenue is essential for individuals looking for to benefit from the Foreign Earned Income Exemption - FEIE Standard Deduction. This procedure entails understanding the meaning of foreign made revenue and the certain eligibility needs that use. Additionally, various calculation approaches can be utilized to properly determine the quantity eligible for exclusionInterpretation of Foreign Earned Revenue

Foreign gained earnings encompasses the payment gotten by people for services carried out in a foreign country. This earnings can consist of wages, wages, benefits, and specialist charges gained while functioning abroad. It is necessary to keep in mind that foreign earned earnings is not restricted to simply cash settlements; it can likewise encompass non-cash advantages, such as housing allocations or the value of meals given by an employer. To certify as foreign gained revenue, the compensation should be stemmed from services done in an international place, not from united state sources. Understanding this definition is vital for people looking for to navigate the intricacies of tax obligation policies connected to gaining revenue overseas, specifically when thinking about the Foreign Earned Revenue Exemption.Qualification Demands Explained

Eligibility for the Foreign Earned Revenue Exclusion pivots on several key demands that people must meet to guarantee their revenue qualifies - FEIE Standard Deduction. To begin with, the private must have international earned earnings, which is income gotten for solutions performed in an international country. On top of that, they should satisfy either the bona fide house examination or the physical existence examination. The authentic home examination needs people to be a local of an international country for an uninterrupted duration that includes an entire tax year. Conversely, the physical existence examination demands being present in an international country for at the very least 330 complete days throughout a 12-month duration. In addition, taxpayers must file a legitimate tax return and claim the exemption making use of Kind 2555Calculation Techniques Introduction

When establishing the amount of foreign made revenue eligible for exemption, people need to consider numerous estimation techniques that precisely show their incomes. One of the most common methods consist of the Physical Existence Examination and the Authentic Residence Examination. The Physical Presence Examination requires people to be literally existing in an international country for at least 330 days within a twelve-month period. On the other hand, the Bona Fide Home Test puts on those who establish a long-term house in a foreign nation for a nonstop period. Each approach has particular requirements that need to be Find Out More satisfied, affecting the quantity of revenue that can be left out. Comprehending these estimation methods is essential for optimizing the advantages of the Foreign Earned Income Exclusion and guaranteeing conformity with IRS laws.

The Role of the Standard Deduction

The standard reduction plays a crucial duty in individual tax filings, supplying taxpayers with a set decrease in their gross income. When combined with the Foreign Earned Revenue Exclusion, it can greatly influence the total tax responsibility for expatriates. Recognizing how these 2 components communicate is important for optimizing tax obligation advantages while living abroad.Criterion Deduction Summary

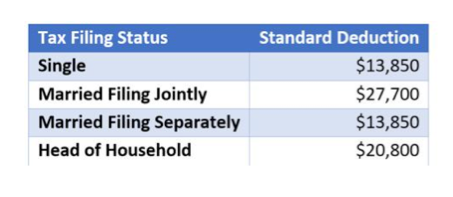

Understanding the conventional deduction is essential for taxpayers seeking to decrease their taxable revenue. The conventional deduction stands for a set buck amount that minimizes the earnings subject to taxation, streamlining the declaring procedure. It varies based upon declaring status-- single, married declaring collectively, wedded declaring independently, or head of home. For numerous taxpayers, especially those without substantial itemized deductions, selecting the typical reduction might be beneficial. This reduction is readjusted every year for inflation, guaranteeing its relevance in time. By using the basic reduction, people can efficiently reduce their tax obligation responsibility, making it a vital element of tax planning. Eventually, recognition of the conventional reduction equips taxpayers to make educated decisions concerning their financial techniques.Communication With Foreign Exclusion

Taxpayers living abroad might gain from both the basic deduction and the Foreign Earned Revenue Exclusion (FEIE) The FEIE enables eligible people to exclude a substantial part of their international income from united state taxes, while the standard reduction decreases gross income for all taxpayers. Importantly, the common reduction can still apply also when using the FEIE. Taxpayers should keep in mind that the FEIE does not impact the computation of the standard deduction. Solitary filers can claim the common deduction quantity index no matter of their international earnings exemption. This mix can cause considerable tax obligation savings, allowing migrants to minimize their total tax obligation successfully while making sure compliance with U.S. tax responsibilities.Just How FEIE Affects Your Basic Reduction

Maneuvering the interplay between the Foreign Earned Revenue Exclusion (FEIE) and the standard reduction can be intricate for expatriates. The FEIE enables certifying individuals to omit a specific quantity of their foreign gained revenue from U.S. tax, which can greatly influence their total tax obligation. However, it is essential to keep in mind that claiming the FEIE may impact the capability to make use of the conventional deduction.Particularly, if an expatriate chooses to leave out international made income, they can not assert the standard deduction for that tax obligation year. Instead, they may be qualified for a foreign tax obligation credit report, which can be advantageous in particular scenarios. The choice to make use of the FEIE or the common reduction calls for mindful factor to consider of private situations, as it can modify the tax obligation landscape substantially. Recognizing these implications is vital for expatriates looking for to maximize their tax responsibilities while living abroad.

Techniques for Optimizing Your Tax Obligation Benefits

While steering with the intricacies of expatriate taxes, individuals can employ different approaches to optimize their tax obligation advantages. One reliable strategy entails optimizing the Foreign Earned Earnings Exclusion (FEIE) by guaranteeing that all certifying earnings is accurately reported. By timely declaring Type 2555, expatriates can leave out a considerable section of their earnings, decreasing their total taxable amount.In addition, people need to consider their residency condition and how it influences their eligibility for tax advantages. Leveraging readily available deductions, such as housing expenses, can better boost tax obligation cost savings. Participating in tax obligation planning throughout the year, instead of waiting till tax obligation period, permits migrants to make educated financial decisions that align with their tax strategy.

Seeking advice from with a tax specialist skilled in expatriate taxes can offer tailored understandings, making certain compliance while optimizing offered advantages. Through these methods, migrants can properly navigate the complexities of their tax responsibilities.

Usual Blunders to Avoid With FEIE and Reductions

Optimizing the advantages of the Foreign Earned Income Exclusion (FEIE) requires cautious interest to information to prevent typical risks that can undermine tax obligation cost savings. One constant error involves failing to satisfy the residency demands, which can cause disqualification from the exclusion. An additional common mistake is improperly calculating the qualified international gained earnings, causing potential over- or under-reporting. Taxpayers may additionally neglect the requirement to file Form 2555, vital for asserting the FEIE, or misunderstand the partnership in between the FEIE and the common reduction. It's crucial to keep in mind that while the FEIE can decrease gross income, it does not affect the conventional deduction amount, which might trigger complication. Finally, overlooking to preserve proper paperwork, such as proof of residency and earnings resources, can make complex audits or future claims. Recognition of these errors can help people browse the intricacies of worldwide taxation much more properly.Frequently Asked Questions

see this websiteCan I Claim FEIE if I Work From Another Location for a United State Business?

Yes, an individual can assert the Foreign Earned Revenue Exclusion if they work from another location for an U.S. business, offered they meet the qualification demands connected to residency and physical existence in an international nation.Exactly how Does the FEIE Affect My State Tax Obligations?

The Foreign Earned Income Exclusion typically does not impact state tax obligations straight, as guidelines vary by state. Some states might call for locals to report all income, while others straighten with federal exemptions. Specific circumstances will figure out responsibility.Can I Change Between FEIE and the Foreign Tax Credit Scores?

Yes, people can switch over between the Foreign Earned Revenue Exemption and the Foreign Tax Credit Scores. However, they should meticulously take into consideration the implications and constraints of each option for their certain monetary situation and tax year.What Takes place if I Surpass the FEIE Income Limit?

Exceeding the Foreign Earned Income Exemption limit leads to taxable revenue for the excess quantity. This can bring about boosted tax obligation obligation and potential issues in asserting deductions or credit ratings connected to international income.

Does FEIE Use to Independent Individuals?

Yes, the Foreign Earned Revenue Exclusion (FEIE) puts on independent individuals (FEIE Standard Deduction). They can leave out certifying international gained income, supplied they fulfill the essential demands, such as the physical visibility or authentic residence testsThe exclusion applies only to earnings obtained from work or self-employment in a foreign nation and does not cover other kinds of earnings, such as financial investment income. Determining foreign earned earnings is crucial for individuals looking for to profit from the Foreign Earned Earnings Exemption. To begin with, the individual have to have foreign made earnings, which is revenue obtained for solutions done in an international country. The FEIE allows eligible people to omit a substantial section of their foreign income from U.S. tax, while the common reduction reduces taxable income for all taxpayers. One reliable approach entails maximizing the Foreign Earned Earnings Exclusion (FEIE) by making sure that all qualifying earnings is precisely reported.

Report this wiki page